The company offers completely free filings for LLCs and corporations alike, allowing you to pay only for your state’s filing fee. While they’re not the only business formation service on the market to offer free LLC filings, they’re one of the few to offer free incorporation services. For example, you might mistakenly list one of the members as just a manager when they are actually a member and a manager and you’ll have to amend your filing to correct it. If you list yourself, it is easy to forget to update your address if it changes.

ZenBusiness – Best for Business Planning and Branding

Rocket Lawyer is very proactive in helping customers premium vs discount bonds start their businesses. If you start the process but pause, a team member will email you to ask if you need assistance finishing the process. I appreciated ZenBusiness’s personalized approach to the sign-up process.

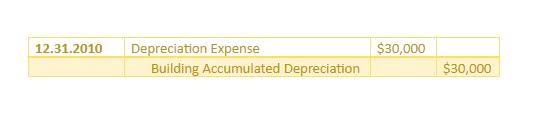

In reviewing some of the most popular and reputable LLC services, the best options worth considering are LegalZoom, ZenBusiness, Rocket Lawyer and Bizee. The following chart gives an idea of plan pricing and overall costs managerial accounting vs. financial accounting for each service. Ask yourself which areas of your business could use some outside help. Then, look for LLC services with add-on services that you can benefit from. I did not like that Northwest took you partially through the sign-up process and then halted everything to get you to create an account. It would have been less jarring to begin the process by creating an account or holding this option until the end at the checkout page.

From wills to powers of attorney, the right estate planning documents can safeguard you and your loved ones—both now, and later. Providing access to our independent network of attorneys over 650,000 times. Helping entrepreneurs turn ideas into businesses over 2 million times.

Build a Team

This means that you need to sell at least 456 units just to cover your costs. If you can sell more than 456 units in your first month, you will make a profit. When you know how much you need to get started with your business, you need to know the point at which your business makes money. If you sell a product, you need an inventory function in your accounting software to manage and track inventory.

Start A Limited Liability Company Online Today with ZenBusiness

- However, credit score alone does not guarantee or imply approval for any financing or service offer.

- With that said, a significant number of people seem to feel the service is just okay, if not somewhat mediocre.

- Signing up for the free Starter package involves providing your business name, the name of the LLC members, your mailing address and your contact details.

- I also noted during the signup phase is that that Northwest Registered Agent didn’t reveal total service charges until I created an account.

- Unhappy customers stated that they weren’t given clear directions about fees or got spammed repeatedly about add-ons.

I found the sign-up process to be less user-friendly than other sites that guide you through a detailed question process. But with Active Filings, you do have all the information in front of you on one page, which can be helpful. Signing up for the free Starter package involves providing your business name, the name of the LLC members, your mailing address and your contact details.

There are rules around how it can use its profits — profits can’t go toward political goals, for example. How you build your business impacts every moving part, from whether or not you can get financing to how you operate on a daily basis. Any personal views and opinions expressed are the author’s alone, and do not necessarily reflect the viewpoint of Nav. Editorial content is not that are health insurance premiums tax deductible of the companies mentioned, and has not been reviewed, approved or otherwise endorsed by any of these entities. I am a repeat customer and wouldn’t trust anyone else with my business details. Corporations are often seen as more credible, which can make it easier to do business with other companies.